Starting off with business seems apparently easy but tracking the expense of the business is a difficult story altogether. However, as much professional you could be, you must know how to track business expenses; otherwise, all your effort will be in vain.

We have seen various kinds of people with various mentality; some feel that investment in the business as much as required while setting it up is important. While some others believe that the more you will spend, the more you will bring in. But that is not the case; in the case of business, it is very important to understand that unless you find out your expenses, you will not be able to calculate your actual profit.

I have seen many businessmen being very relaxed about not being able to track the business expense. Many of them often say proudly when questioned, “How to track your business?” and laughed away, saying, “why do we need to track our business?”

Hence, in most of the business all over the world, only the successful people know how to track business expenses. I know you, too, want to know more about it, so today, I will tell you here about how to track your business expenses in an easy manner, following some quick steps.

Also Read: Track all your Business expenses through expense management software

How to Track Business Expenses: A Beginner’s Approach

When I wanted to track my business expense, I had no one to guide me on this subject. But now there are several internet blogs and posts which talk about tracking expenses of running a business. But I think the practical idea matters more than just a research idea.

I have been through that stage, and I know how exactly we should start tracking our business expenses. Hence, I decided to come up with this topic and show you how to track your business expenses very easily without any professional expertise.

- Start a business bank account

- Select a correct accounting system

- Preferably choose a cash or accrual accounting method

- Connect all the financial institutions

- Start managing your receipts correctly

- Record all the expenses

- Consider using one of the expense recording applications.

I would like to give you a detailed experience of how to track your business expenses, so I will start from level zero.

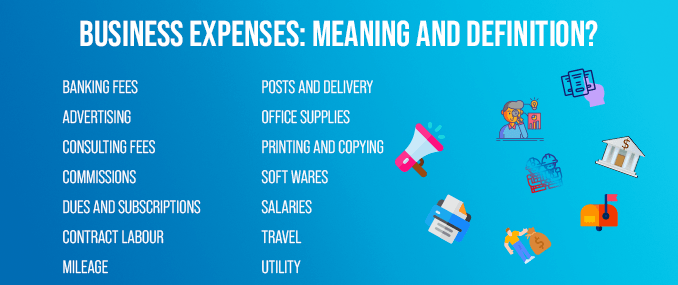

Business Expenses: Meaning and Definition?

The process of bookkeeping is also known as tracking business. Well, many businessmen calculate just the bigger expenses and ignore the small ones. But if you wish to track your business expenses correctly and you need to consider every small and big expenditure of the business. I have gathered all the possible sectors of investment for you over here.

- Banking Fees

- Advertising

- Consulting Fees

- Commissions

- Dues and subscriptions

- Contract Labour

- Mileage

- Posts and Delivery

- Office supplies

- Printing and Copying

- Softwares

- Salaries

- Travel

- Utility

While these are considered as the major expense categories but there are a lot more than these which are associated with the business.

7 Ways you can use to Track all Business Expenses

Tracking the business expenses very efficiently is like a real pain, but if you know how to track the business expenses very correctly, then you will be in the upper hand. You will know that what exactly should you do and what kind of approach must you make in order to calculate the expenditure.

I would recommend you use accounting software, which will help you to calculate the expenses, track them, classify them, and get access to the total amount of the item. You must be sure that you have all your hands and control over the money of your business and know exactly what is happening in the accounts department. This is actually important for the tax times because you need to be sure of all the expenses that you have.

I will tell you here the ways how to track your business expenses following some of the steps below.

1. Start a Business Bank Account

If you are a new business owner, then you will have to open a new bank account. Once you successfully open an account and then make sure that the account is used for all business transaction purposes only. If you want to know how to track your business expenses correctly, then you will have to first open a separate bank account.

Often you might feel that it is your company so you can make some expenditure from your personal bank account, but that is the biggest mistake that you will make. Hence keep your personal bank account and business bank account very separate. This will help you to keep the exact track of the money going out from the account and coming in and the final account.

2. Select a Correct Accounting System

As you know, there are various types of accounting systems, but if you are not too sure about which type of bank account is good for your business, then you can seek the help of the bank officials. The bank officials will help you to understand the kind of banking accounting. Besides choosing the correct business option, you must also choose the correct tracking software that will help you to track the expenses.

Microsoft is easy to use and easy to handle, so you can use it easily for keeping account of the business expenses. But you can also use other tracking software, and it is better that you keep the access of it with yourself and not give it to anyone else. I would recommend that MS. Excel is easy to use; hence the first choice must be that or else there is another kind of software too that you can use to track the total expense of your business.

3. Preferably Choose a Cash or Accrual Accounting Method

If you are using the banking system for the first time, then there are some minimum that you should know like there are two options available for you. You can either choose the cash method, or you can also choose the accounting method. Most of the small businessmen and the freelancers use the cash accounting method as it is easy to use.

The use of the cash accounting method is very easy to use; this helps you to track the record of the transactions that are made. This helps you to keep track of the money going out and coming in as soon as the money is transferred. It keeps a record of the money that is used and is for whatever purpose possible.

The Accrual accounting system is a little different; most of us are unaware of the accrual system of banking. It is the basic necessity of growing any business, in my opinion. It helps to understand the business expenses in in-depth, also helps the business to grow and give some good expanses. It makes business extremely easy as if you sell off anything; the amount of the money is directly added to the bank account.

4. Connect all the Financial Institutions

Many of you often have the correct banking system and the correct tracking application but even then fail to understand how to track your business expenses correctly. It is very important for them to understand that you need to connect your financial institute with the tracking software. This will make tracking easy; as soon as there is some financial exchange happening, it will be directed recorded in the software.

Some of you may not be very happy with this kind of option but still, this is the best method for you. It is actually very safe to use the tracking software and the banking system hand in hand so that the money is recorded at once.

Read more: 7 Financial Decisions of the 20s for a Prosperous 30s

5. Start Managing Your Receipts Correctly

I understand that you being the owner of the organization might not always be able to keep account of all small expenses that are required. But you can still keep a tab on the expenses, give access to the accounts department to handle and use the accounts of the business, but even then, you can at least keep track of how the business is working with respect to the money.

If you think your software is fulfilling your requirement, then you can choose to change the application that you have chosen to track the business.

6. Record all the Expenses

If you have a business, then you must be very aware of all the expenses, and you must know how to account for all the businesses. At the same time, it can be done in many ways, but for the ones who still have a question in mind regarding how to track your business expenses since they are actually worried about the expenses.

The easiest way to record all your business expenses is to connect your banking system with your software application. But there are other ways too, depending on what kind of recording method you want to follow. This process is very fair and mostly automated; hence you need to pay much of time and effort on it. Keep a tab on your banking system on a monthly basis and understand the expenses in a month-wise manner so that you know exactly how what all happened this month.

7. Consider Using One of the Expense Recording Applications

After telling you everything, I think by now you are pretty clear about what kind of steps you must take to record your expenses. But even then, one last point that I think I must repeat is to choose the correct application for recording the business expenses.

How to Track Your Business Expenses Using Other Methods?

The most common method is the one which I mentioned above, but is that the only way? No!

There are many more ways in which you can track the business expenses very effectively; I will tell you about some other methods that you can follow.

If you have Fewer Expenses –

If you are just starting with your business, and if you think you have very few things to track, then you can simply track using a spreadsheet. But gradually, over a period of time, when you know that your expenses are increasing, then it would be a good idea to switch on to any software.

If you are good at Excel Whiz –

Everyone is aware that whiz can perform a lot of work, and it is one of the finest choices for anyone. It is also like a spreadsheet, but it is much easier to use and keep an account of all expenses.

Wrapping Up!

Irrespective of whether you are just starting up a business or if you have been in the business for the longest, the terms remain the same. It is the best idea to know how to track your business expenses right from setting up your business, and it will give you some fruitful results with all respect.

I would be glad if you let me know if you have any queries or if you wish to discuss anything with me. You can just comment below in the comment section and let me know if you have any more queries regarding how to track your business expenses easily.

Read Also:

- 3 Things You Should Do to Become Self-Employed

- List of Top 8 Office Equipment that Every Business Needs

- How To Relocate Your Small Business

- How To Run A Successful Small Business: 6 Tips For New Owners

View on:

How To Track Business Expenses and Income in Excel! (Free Excel Profit and Loss Statement)