Are you thinking about investing in crypto ETFs? Then you might find this article interesting. In the investment world, ETFs or exchange-traded funds are new but offer great investment opportunities for everyone.

So, if you are looking to diversify your investment portfolio, then ETF can be a great option. Additionally, cryptocurrencies like Bitcoin or Ether have given high returns, which has pushed several investors to invest in crypto.

However, you require a lot of funds to purchase a single Bitcoin, which is not possible for everyone to invest in. Therefore, cryptocurrency ETFs were introduced in the market so that all investors interested in crypto could invest.

You, too, can capitalize from cryptocurrency ETFs; therefore, we have provided you with the top crypto exchange-traded funds in 2024. Additionally, you can invest in these ETFs based on your preference and knowledge about ETFs. Furthermore, if you want to learn more about ‘What are ETFs?’ and how they work, then read this article.

What is Crypto ETF?

Crypto ETFs or cryptocurrency exchange-traded funds invest in cryptocurrencies like Bitcoin (BTC) or Ether (ETH). These cryptocurrency ETFs track all the performances of the cryptocurrencies within the portfolio and capitalize on the crypto exchange-traded fund.

You can purchase cryptocurrency ETFs from regular stock exchanges just like individual stocks. Then, hold the ETF you purchased in your standard brokerage accounts like any other exchange-traded funds you have kept.

Exchange-traded funds allowed investors to invest in cryptocurrency ETFs since January 2024. So, you can also invest in cryptocurrency holdings and earn your profits.

Previously, you were not allowed to invest in crypto ETFs as it was not approved by the Securities and Exchange Commission (SEC). However, now you can because it has been approved.

According to SEC Gary Gensler, “While we approved the listing and trading of certain spot Bitcoin ETF shares today, we did not approve or endorse Bitcoin. Investors should remain cautious about the myriad risks associated with Bitcoin and products whose value is tied to crypto.”

So, you get a warning and approval to invest in cryptocurrency ETFs at your risk. If you wish to know the predictions on Bitcoin ETF, then read this article. Additionally, for better understanding of investment trends it’s better to do your own research. Furthermore, if you are new to investment read the best investment books that guide you about various investment options.

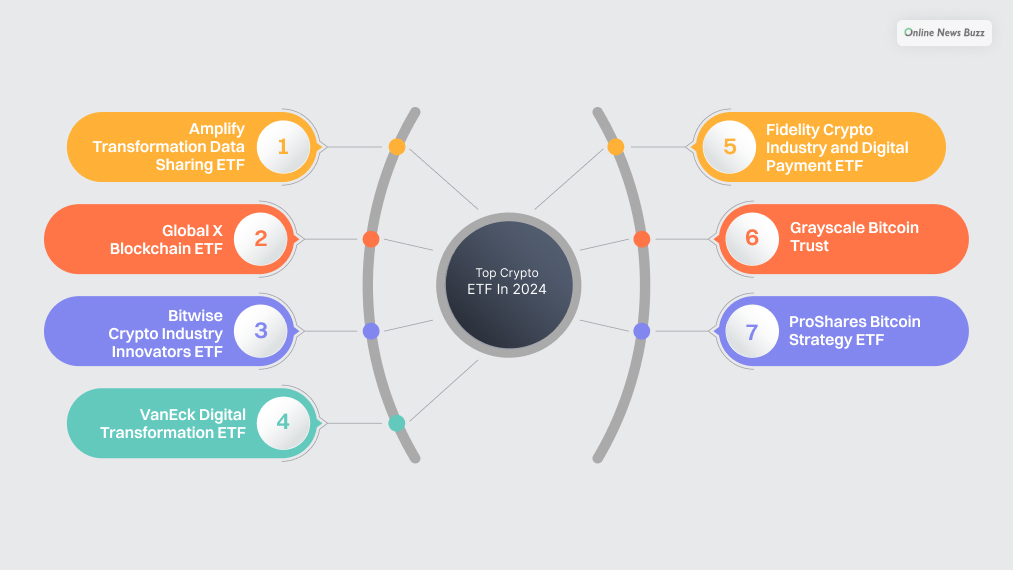

Top Crypto ETF In 2024

If you want to invest in cryptocurrency ETFs, these seven cryptocurrency ETFs are among the best in the market. Let’s dig deep into these seven cryptocurrency ETFs to understand their position in the crypto exchange.

Amplify Transformation Data Sharing ETF (BLOK)

You can invest in Amplify Transformation Data Sharing ETF (BLOK) the first ETF dedicated to cryptocurrency blockchain technology. Since it’s launched in 2018, this crypto exchange-traded fund has grown and now holds 735 million dollar’s worth of crypto assets under it. Remember, this is an active fund, so the expense ratio is higher.

If you want to invest in this crypto ETF, then the expense ratio of this fund is 0.76%. Additionally, choose Amplify Transformation Data Sharing ETF if you want to invest in companies advancing blockchain technologies.

Furthermore, this fund targets companies that are mining cryptocurrencies. So, you can take advantage of the new blockchain application and cryptocurrencies when investing in this fund.

Global X Blockchain ETF (BKCH)

Are you looking to invest in passively managed crypto exchange-traded funds? Then, you can invest in Global X Blockchain ETF. Additionally, under this fund, there are 160 million dollar’s worth of crypto-related assets.

It would help if you bore an exchange ratio of 0.50% on this fund, which is a relatively lower expense ratio. Furthermore, this fund invests in crypto mining companies, companies developing blockchain applications, and crypto exchanges. So, you can capitalize on the crypto industry’s growth. The benchmark for this fund is the Solactive Blockchain Index.

Bitwise Crypto Industry Innovators ETF (BITQ)

Another passively managed crypto ETF is Bitwise Crypto Industry Innovators ETF. Under this fund, you have 135 million dollars worth of crypto assets that you can capitalize on.

Bitwise Crypto Industry Innovators ETF holds 30 crypto innovator companies’ stocks and tracks the Bitwise Crypto Innovators 30 Index. When investing in this fund, you bear a 0.85% expense ratio.

If you are looking to diversify your investment portfolio, then you can invest in mutual fund and ETF. Are you not sure which investment option is best for you between ETF and Mutual Fund? Then, you might want to read this article on ETF vs mutual fund.

VanEck Digital Transformation ETF (DAPP)

You have a newly launched crypto exchange-traded fund, VanEck Digital Transformation ETF, launched in 2021. Additionally, you can invest in this passive fund and bear an expense ratio of 0.51%. You have 106 million dollars worth of crypto assets under this fund.

Additionally, this fund tracks the MVIS Global Digital Assets Equity Index. You can invest in this fund, which holds stocks of companies actively involved in blockchain and cryptocurrency. This exchange-traded fund has international stocks based outside the U.S.

Fidelity Crypto Industry and Digital Payment ETF (FDIG)

Are you looking for a lower expense ratio crypto ETF to invest in? Then, you can invest in the Fidelity Crypto Industry and Digital Payment ETF launched in 2022. Additionally, when you invest in this passive fund you bear an exchange ratio of 0.39%.

DFIG has 31 stocks in the tech industry and financial services and has 103 million dollars worth of crypto-related assets. The benchmark for this fund is the Fidelity Crypto Industry and Digital Payment Index.

FDIG owns stocks of companies invested in global blockchain, cryptocurrency, and digital payment companies. Additionally, you can earn profits through this fund because of the growing popularity of cryptocurrency and digitalized payments.

Furthermore, you get to increase your investment because this industry has grown rapidly since digitalization.

Grayscale Bitcoin Trust (GBTC)

Grayscale Bitcoin Trust is a great option if you want to invest in Bitcoin. This crypto ETF comprises 25.7 billion dollars worth of Bitcoin-related assets and is fully invested in the digital currency.

If you cannot own a Bitcoin because of a lack of funds, this ETF can be your chance to get returns on Bitcoin. Initially, this exchange-traded fund launched as a trust in 2013, but it is now an ETF. Additionally, if you invest in this fund, you must bear the expense ratio of 1.50%.

GBTC is a spot Bitcoin and the largest of the 11 spot Bitcoin ETFs introduced in 2024. The Securities and Exchange Commission finally allowed 11 Bitcoin ETFs to trade on the stock exchange. So, investors can invest in crypto without worrying about owning a cryptocurrency.

You do not have to know about crypto, blockchain, security keys, and other hassle related to purchasing a crypto. Additionally, you can avoid all the hassles associated with owning if you invest in cryptocurrency ETFs.

ProShares Bitcoin Strategy ETF (BITO)

Another cryptocurrency ETF leading among crypto exchanges is the ProShares Bitcoin Strategy ETF. BITO consists of 2.5 billion dollars in assets and is an actively managed fund. Therefore, you need to bear an expense ratio of 0.95%, and this fund trades in future Bitcoin contracts.

So, all the prices are predictions of future crypto holdings or asset prices, not the spot price. However, even after investing in future contracts for Bitcoin since its launch in 2021, this fund has grown rapidly.

Additionally, this crypto exchange-traded fund is the first Bitcoin futures ETF on the exchange and is leading in the category.

Benefits Of Crypto ETFs

You might be thinking that there are several ETFs to invest in but why should you invest in cryptocurrency ETFs? According to Galaxy, the assets under Bitcoin Exchange-traded funds and close-ended funds have grown to 21.7 billion dollars.

Therefore, you see the popularity of crypto exchange-traded funds. So, here are some advantages of investing in crypto ETFs.

Diversification

If you want to diversify your investment portfolio, crypto exchange-traded funds are a great option. Since crypto is a type of asset, you can invest in crypto to diversify your investment.

Additionally, you already know how much returns cryptocurrencies have provided in the last decade, making it an attractive asset for investment. Furthermore, when you invest in cryptocurrency ETFs, you get to invest in more than one cryptocurrency. Therefore, you diversify your investment in the crypto world, too.

Instead of risking all your investment in buying a single crypto, you can diversify your investment and avoid significant risks. Additionally, you can invest in other ETFs like gold ETF or Equity ETF to diversify your portfolio.

Simple And Efficient

If you need to learn how many securities processes you need to cross to purchase a Bitcoin, read this article on facts about Bitcoin. Additionally, purchasing a cryptocurrency ETF is easier than holding a crypto directly because you must navigate various security procedures.

Furthermore, you must create a wallet on your exchange platform to hold and secure your crypto with a security key. Additionally, you must link your bank account with a crypto exchange to buy and sell your crypto.

Furthermore, it would help if you safeguarded the security key to your exchange wallet from cyber threats and hackers. Your exchange accounts and other information might be hacked if not protected properly.

All these hassles make owning a crypto complicated. On the other hand, when you purchase shares in cryptocurrency ETF, you can avoid all these hassles. This simplicity of owning cryptocurrencies and ETFs makes investing attractive for investors.

You need to invest in cryptocurrency ETF from your brokerage account and let your money work for you.

Security

You already know you require a security key to secure your cryptocurrency in your exchange wallet. Your crypto exchange provides you with the service to store the security keys to your cryptocurrencies in your exchange account. However, not all exchanges provide this service. This makes it hard to secure your security keys from hackers.

Additionally, your exchange account and wallets can be hacked even if they are under your exchange account because of increased security threats. Therefore, owning a crypto becomes much riskier for ordinary investors.

However, when you purchase an ETF, you do not own any cryptocurrencies, and there is a risk in accompanying crypto. Yet you get to capitalize on the price performance of crypto. This makes crypto ETFs a much more attractive investment option regarding security risks.

Wrapping Up

So, if you are interested in crypto ETFs, you should do your own research on exchange-traded funds. This will increase your chances of investing in exchange-traded funds that will give you higher returns.

Additionally, you must read more investment books to learn more about other investing opportunities to diversify your portfolio. Whether you invest in exchange-traded funds or mutual funds, you will decrease your chances of a loss if you understand the market.

Furthermore, you must remember that the cryptocurrency market is new, and volatility is a matter of concern. So, you must trade at your own risk and understand your own financial goal before trading.

Read Also: