Are you thinking about doing passive investment? Did you hear about ETFs investment and want to know more about them? Then this is the right place to start because we have created a guide on ETFs.

Investment has become a common route of generating income globally. You can invest in assets, stocks, and businesses to get returns on your investment. Additionally, you have several investment fund options, such as bonds, fixed deposits, and retirement investments, to invest your money.

Furthermore, some investment funds are under government control, so you can be assured of getting your returns on time. Hence, if you wish to earn an income and grow your savings, you can opt for ETFs or Exchange-Trade Funds.

Do you want to know ‘what are ETFs?’ You can read this article to learn more about them. Additionally, reading this article will give you all the necessary information on how and why you must invest in ETFs.

What are ETFs?

So, what are ETFs? Exchange-Trade funds, ETFs are funds that you trade on exchanges. So, when investing in an ETF, you get access to a bundle of assets you can purchase and sell within market hours.

You can treat exchange-traded funds like stocks you purchase and sell for profits. Additionally, you can track the rates and securities of the commodity you have purchased. Furthermore, you can design your ETFs to track specific investment strategies that you can apply.

You can invest in several types of ETFs to generate passive income on your investment. Additionally, you can speculate on ETFs and wait for the funds to increase in price to sell them. Furthermore, ETFs are a great option if you wish to diversify your investment portfolio to avoid major risks partly.

Understanding the Basics of ETFs

You should understand a few basics of ETFs now that you know ‘What are ETFs?’

You have two basic types of ETFs: active ETFs and passive ETFs. Additionally, you must pay ETF charges on every ETF investment you make. Furthermore, most ETFs offer you dividends you can take as cash or reinvest.

Let’s understand these basics of ETFs in detail.

Active ETFs

When you opt for active ETFs, your funds get managed by investors you hire to look after your investments. You take advantage of the portfolio manager’s knowledge to increase your chances of getting higher profits.

Passive ETFs

When you opt for passive ETFs, you simply track your stock index. For example, you have Nasdaq and S&P 500 as your passive ETFs. You can also invest in gold ETF.

Expense Ratio

You will be charged a certain fee when you purchase an exchange-traded fund. These charges are also called expense ratios. Additionally, the expense ratio is listed annually. So, you will be charged a certain amount of money yearly on your invested amount.

For example, you are charged a 1% expense ratio on your ETFs. So, for every 1000 dollars you invest, you must pay the portfolio manager 10 dollars. When investing in exchange-traded funds to save money, it would help if you looked for a lower expense ratio.

Dividends

When you purchase exchange-traded funds, it will pay you dividends. Dividends are your earnings from your invested stock in the market. You get dividends generally quarterly, either in cash or stock reinvestment.

If you wish to take your dividend in cash, it will directly transfer to your linked bank account. Furthermore, opt for a DRIP or dividend reinvestment plan if you want to reinvest your dividend automatically.

You must know a few basics of ETFs before investing in exchange-traded funds.

Different Types of ETFs

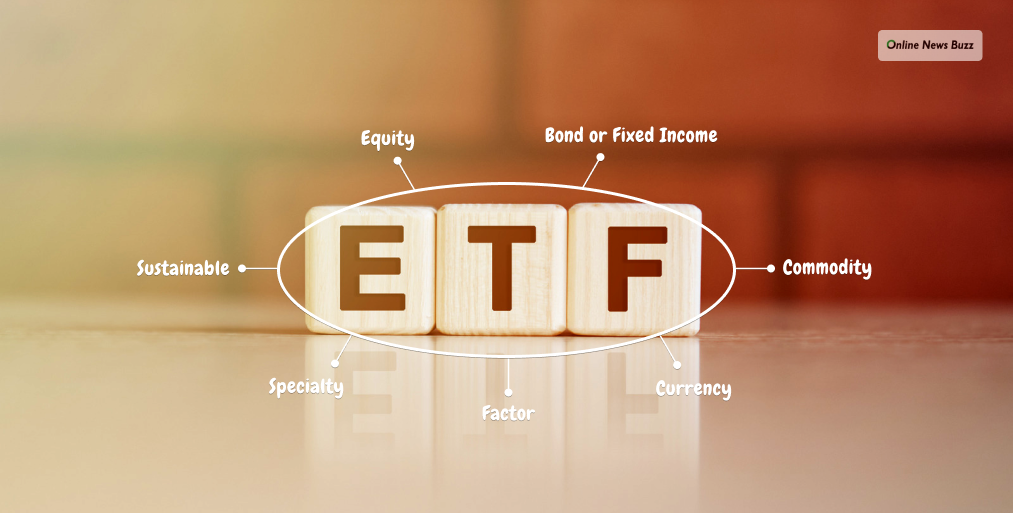

Now that you know ‘what are ETFs’, let’s learn the different types of ETFs you can invest in. According to BlackRock, there are seven major types of ETFs, which we have listed below.

Equity ETFs

You can purchase equity ETFs that are equities in businesses, industries, or stocks in specific countries. Additionally, you can purchase their equity ETFs if you wish to invest in a growing business or industry.

According to Statista, there has been an astonishing 3000% growth in ETFs in the market since 2003. If you plan to invest in equity ETFs, you must know that equity ETFs have a higher return and risks.

Bond or Fixed Income ETFs

Similarly, you can invest in bond or fixed deposit ETFs to provide you with a steady return of income. Additionally, if you wish to lower your risks in ETF investment, then this type of ETF is best for you.

Commodity ETFs

What are ETFs in commodities? Commodities like gold, silver, and oil also have ETFs in which you can invest. You will find that these ETFs are harder to access than equity bond or fixed deposit ETFs.

Additionally, when you own these commodity ETFs, you don’t get to own the assets but its derivatives. These derivatives help you track the price of the commodity you invested in. According to Statista, gold price has reached 2000 dollars USD per ounce as of 2022 and remain high.

Currency ETFs

Furthermore, you can invest in currency ETFs based on a bunch of currencies or a single currency. Suppose you wish to invest in US dollar ETFs; in this case, you can invest directly or use derivatives.

Additionally, you can invest in many currencies ETFs and minimize risk through direct and derivative investments.

If you want to diversify your investment in currency ETF then crypto ETF are great option. Cryptocurrency ETFs like Bitcoin ETF can give high returns on your investment.

Factor ETFs

Then, you have ‘factor ETFs’ or ‘smart beta,’ which are investment options through which you can try to minimize investment risks. Several investors opt for Factor ETFs to diversify their investment portfolio and enhance performance.

Sustainable ETFs

You can invest in sustainable ETFs, and sectors that help develop sustainable products. This sustainable industry is growing rapidly with increased awareness of climate change and its effects. So, you can invest in sustainable ETFs focused on bringing about positive environmental and societal changes.

Specialty ETFs

Want to know which ETFs you can invest in to get potential larger growth in your investments? Then, you can opt for specialty ETFs. These new ETFs have two types: inverse funds and leveraged funds.

You can get higher returns on your investment if you purchase these funds, but it also comes with increased risks. So, you might have to take risks to gain more profits on your specialty ETF investment.

The target index decreases with inverse funds, and the prices of inverse funds increase. On the other hand, leveraged funds leverage more investment in the fund to maximize the returns.

How To Invest in ETFs?

Now, let’s move on to how you can invest in ETFs after learning about ‘what are ETFs,’ and different ETFs. So, how will you invest in ETFs? You can easily understand exchange-traded funds and invest in them to generate impressive returns.

Here is how you can start your journey to investing in ETFs and generating passive income.

Open Brokerage Account

Firstly, you can open a brokerage account. Here is how you can do it. You can choose any online brokerage or a broker to start your investment journey.

You can opt for a well-known investment broker if you are new to investing. Your broker can educate you on which ETFs to invest in for greater returns. Additionally, your broker will advise which ETFs are best for a steady income or have fewer risks.

If you are experienced in investing or don’t want a broker to choose which ETFs to invest in, you can select an online brokerage. Here, you can trade in any ETFs as you wish. Additionally, you can opt for commission-free stocks, which some online brokerages offer.

Furthermore, you must provide your identity proof, address proof, and bank details to open a brokerage account. At present, you will find several investors opening Demat accounts and linking their trading accounts with them.

Demat accounts are digital spaces where you can hold purchased securities like bonds, stocks, and mutual funds. You can open a Demat account in the same format as an online brokerage account.

Read this article if you wish to learn what else you can do with your Demat account.

Select ETFs You Want To Invest In

Secondly, you can choose an exchange-traded fund and invest in it. If you are new to investing in exchange-traded funds, opt for passive index funds because they are cheaper.

Additionally, you can opt for active index funds to invest in if you want higher returns on your investment. But remember, these index funds come with higher risks. So, take your risks with careful consideration and research.

You can read various investment books and research on exchange-traded funds in the market. Additionally, you will gain knowledge and insights about ETFs when you read more investment-related articles.

Furthermore, knowing the topic of interest can increase your chances of investing in the right exchange-traded funds. Therefore, it helps you get higher returns on your investment.

When you pick high-performing ETFs, your income increases exponentially.

Wrapping Up

Now that you are caught up on ‘what are ETFs?’ and how to invest in them, you can start your exchange-traded funds investment journey.

Before investing in ETFs, be sure to research which are the best ETFs to invest in the market. This will ensure you get the best returns on your investment. You can read the best investment books in the market to learn more about ETF investment.

After all, you wanted to have a passive income to help secure your finances in the first place. So, let the ETFs do the heavy lifting to give higher returns on your investment. This can only be possible when you invest in good exchange-traded funds.