Short-term cash loans are a very popular alternative to traditional loans. As the name suggests, the key characteristic of a short-term loan is its short repayment cycle. This may appeal to borrowers who need an immediate injection of cash but would prefer not to bog themselves down in long-term debt.

Loan Terms

A loan term is a period within which the loan principal amount and associated interest must be repaid to the lender. Loan terms are generally divided into three categories:

- Long term – From 5 years onwards, usually capped at 25 years

- Medium-term – Between 2 and 5 years

- Short term – May be capped at 18 to 24 months but usually less than 1 year; possibly as short as a month or even a week

Short-term loans can involve a principal sum as low as $100 but may also be as large as $100,000.

They are often referred to as payday loans. This is because borrowers pay them off when they receive their salary the following week or month.

Who Are Short-Term Cash Loans For?

Instant cash loans are very popular because they are such a versatile financial option, suited to a wide range of consumers’ needs. These loans are an ideal alternative for those who don’t usually borrow money but happen to find themselves in immediate need of cash.

Many small and medium enterprise (SME) business owners rely on such loans to bridge the gap and maintain operations if their income is disrupted. This has been a common reason for the spike in short-term loans during the Covid lockdowns.

A salaried borrower may rely on these loans to cover a mortgage payment after emergency expenses leave them temporarily short of funds. Others may need a short-term loan to cover such emergency expenses themselves.

Licensed money lenders in Singapore will rarely delve too deeply into your reasons for applying. The application process is more focused on your ability to repay the loan as scheduled.

Do I Qualify For A Short-Term Cash Loan?

The requirements to qualify for fast payday loans online are largely the same as those for other loans. Licensed money lenders consider your ability to repay the loan as their primary concern. You can demonstrate this capacity by providing evidence of your income at the loan application stage.

The documents you may provide generally include:

- Recent personal bank statements

- Recent bank statements for your business

- Statements of CPF contributions

However, money lenders will also take into consideration alternative sources of income. You may also want to share documents that show you receive income from:

- Dividends from stocks and shares

- Interest earned on fixed deposits

- A pension

- Alimony and child care payments

- Government payments, e.g., Covid-19 benefits

- Ongoing insurance payments

- Inheritance

Note that a Singapore cash loan is generally an unsecured loan. This means you will not have to put up collateral such as a home or car as security.

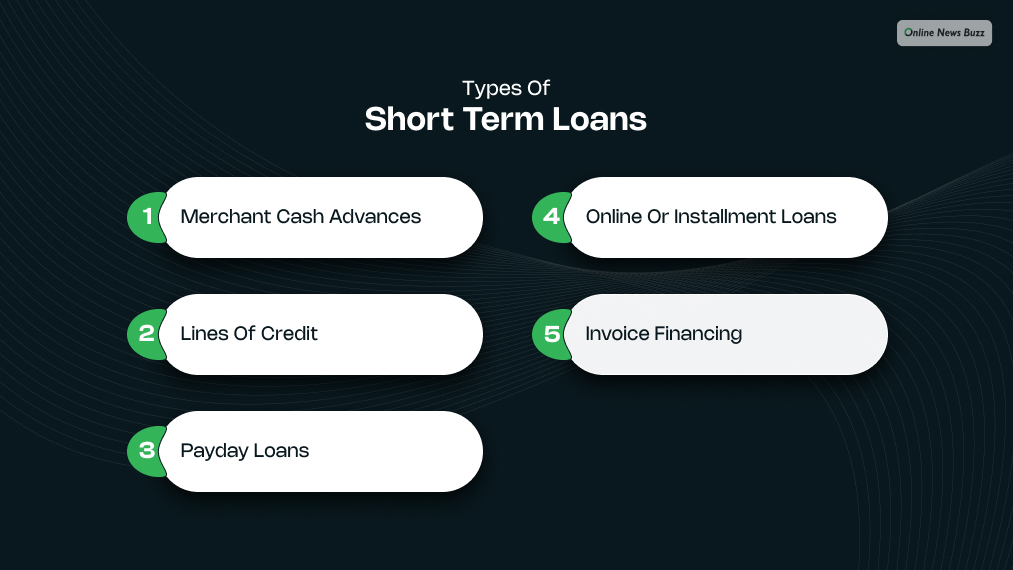

Types of Short-Term Loans

Short-term loans come in various forms, as listed below:

1. Merchant cash advances

This type of short-term loan is actually a cash advance but one that still operates like a loan. The lender loans the amount needed by the borrower. The borrower makes the loan payments by allowing the lender to access the borrower’s credit facility. Each time a purchase by a customer of the borrower is made, a certain percentage of the proceeds is taken by the lender until the loan is repaid.

2. Lines of credit

A line of credit is much like using a business credit card. A credit limit is set and the business is able to tap into the line of credit as needed. It makes monthly installment payments against whatever amount has been borrowed.

Therefore, monthly payments due vary in accordance with how much of the line of credit has been accessed. One advantage of lines of credit over business credit cards is that the former typically charge a lower Annual Percentage Rate (APR).

3. Payday loans

Payday loans are emergency short-term loans that are relatively easy to obtain. Even high street lenders offer them. The drawback is that the entire loan amount, plus interest, must be paid in one lump sum when the borrower’s payday arrives.

Repayments are typically done by the lender taking out the amount from the borrower’s bank account, using the continuous payment authority. Payday loans typically carry very high interest rates.

4. Online or Installment loans

It is also relatively easy to get a short-term loan where everything is done online – from application to approval. Within minutes of getting the loan approval, the money is wired to the borrower’s bank account.

5. Invoice financing

This type of loan is done by using a business’s accounts receivables – invoices that are, as yet, unpaid by customers. The lender loans the money and charges interest based on the number of weeks that invoices remain outstanding. When an invoice gets paid, the lender will interrupt the payment of the invoice and take the interest charged on the loan before returning to the borrower what is due to the business.

Wrapping Up!

For novice borrowers, a short-term loan is a gentle introduction to debt. It exposes you to the financial system and its regulations without compelling you into long-term commitments.

It also works to improve your credit score. Repayment of a short-term loan demonstrates your ability to abide by your financial responsibilities, however small they may be. An improved credit rating will subsequently render you eligible for larger loan principals and lower interest rates, as well as loans from major financial institutions.

If you are struggling to pay your bills, keep your business afloat, or contend with unexpected expenses, a short-term cash loan may be the answer.

Read Also: