If you’re hunting for fast business capital, Torro Business Funding is a name that comes up a lot. Torro-appropriately branded Torro Funding/Torro Business Funding-positions itself as a marketplace and syndication platform matching small businesses, including startups and low-credit borrowers, with investor partners and loan products.

This review breaks down the essentials you need to know in 2025: legitimacy, loan terms, how it compares to other lenders, pros and cons, qualification rules, how to apply, complaint patterns, and more. Wherever possible I’ve cited third-party sources and Torro’s own materials so you can verify details.

Is Torro Legit?

Short answer: Yes — but know what “legit” means here.

Torro operates an online funding marketplace and has been in the business funding space since about 2015. Its websites contain application portals and product pages that describe funding amounts and programs.

Torro boasts an accredited status with the BBB, with high ratings across many BBB listings (some A+ rated) and thousands of customers raving about quick funding and responsive customer service across platforms like Trustpilot and Best Company. That lends credibility.

- Important nuance: Torro usually extends funding through a network of affiliate investors-a loan syndication model.

This means Torro is not necessarily the ultimate lender; rather, it provides a matching service with investor(s) and helps structure funding, which means that the fees and APRs on deals can vary. Consider Torro a broker/marketplace, not one single bank.

How Torro Compares to Other Lenders?

How Torro stacks up depends on what you compare it to:

- Vs. traditional banks / SBA: Torro is much quicker and tolerates riskier borrowers-e.g., lower credit scores, startups-but costs are typically higher than SBA or bank loans, and terms are shorter.

- Vs. alternative/online lenders & marketplaces (Lendio, Fundera, etc.): Torro’s strength is speed and the ability to source funding for startups and lower-credit applicants; competitors may offer broader product catalogs, more transparent pricing comparisons, or lower rates for established firms. Finder’s comparisons show that Torro performs well on approval flexibility but lags on pre-application pricing transparency.

- Vs. merchant cash advance (MCA) providers: Torro will sometimes facilitate MCA-style funding but also matches to term loans and lines of credit. Expect the same tradeoffs seen industry-wide: immediate cash vs higher effective cost.

If you’d like direct side-by-side cost examples with lenders that match your revenue and credit profile, I can build a comparison table tailored to your needs.

What is the Finder Score?

Finder Score is a proprietary ranking used by Finder (and displayed on their comparison pages) to summarize multiple product characteristics into one number out of 10.

It assesses things like interest rates, fees, loan features and type, and how the product compares for a given borrower type (startup, established business, etc.). It’s a good quick-reference but always match up with the underlying terms and eligibility details.

What Makes Torro Shine?

- Rapid financing: Torro boasts approval and funding in as little as 24 hours for some products — valuable when timing is everything.

- Flexible eligibility: Torro accepts low credit scores – Finder notes credit scores as low as ~400 for some programs – and offers options for startups, which many competitors won’t. That makes it a go-to for riskier or early-stage borrowers.

- Dedicated funding support: Customers commonly praise Torro’s funding specialists for hands-on assistance guiding applicants through documentation and product choice. Independent reviews highlight strong customer service.

- Multiple Product Routes: By utilizing this network, Torro has access to a wide range of funding types, including: short-term, fixed-term, lines of credit, and specialized programs. That increases the chances of approval for varied needs.

Where Torro Falls Short?

- Transparency before Application: Many reviewers and Finder note limited visibility into exact fees, APRs, or detailed repayment terms before applying — you often learn the real costs after lender matching. That unpredictability is a downside for price-sensitive borrowers.

- Variable cost structure: Since Torro syndicates loans through partner investors, APRs and fees can be considerably different between applicants and states; some deals can be expensive compared with bank or SBA alternatives.

- Shorter terms / higher effective rates on some products: Fast, convenience-oriented products (e.g., business cash advances) have higher effective interest rates; Torro supports these products. For low long-term financing costs, traditional channels may beat Torro.

- Mixed user experiences: While overall, clients report a high level of satisfaction, some complaints filed cite surprises regarding fees, delays in communications, or misunderstandings about the final offer — again pointing to the importance of carefully reading the funding agreement.

Torro Loan Details

| Minimum credit score/credit range | 400 |

| APR | Up to 36% |

| Loan amounts | $5000 to $725000 |

| Terms | Varies by funding type |

| Approval Turnaround | Varies by funding type |

| Availability | Available in all states |

| Fees | Varies by funding type |

| Other Fees | N/A |

- Loan amount: Typically $5,000 to $725,000 (product dependent). Similar ranges can be found on marketing pages from both Finder and Torro. Both mention that higher amounts are possible for some programs.

- APR: Finder reports APRs can be up to 36%; this depends on state caps and product types. Some alternative funding options routed through Torro may have higher effective costs when factoring factor rates or fees. Always confirm the APR and total repayment cost on the final agreement.

- Terms: Varies depending on the product (can be as short as 3–24 months for fixed-term funding, or can vary for lines of credit/MCAs).

- Funding speed: Torro markets approvals and funding in as little as 24 hours for eligible applicants; actual timing may vary based on underwriting, verification, and investor actions.

- Availability: Torro is available in various states in the U.S.; product availability and APRs vary depending on local regulations.

How to Qualify Torro?

Torro has program-specific qualification rules. Finder summarizes two core program tracks:

- BVR Program-for businesses >6 months: ~6+ months in business, gross income above $10,000/month-varies, proof of business identity; higher maximum funding.

- SLOC / startup programs (for new businesses): Torro offers startup funding with specific limits- Finder cites credit score >600 for some startup programs and lower maximum funding like $150k.

It also reports that Torro is willing to consider applicants with lower credit in some cases, such as credit scores as low as 400 for select products. Requirements vary by investor partner.

Other common considerations across Torro deals: business documentation, bank statements, personal credit history, and recent credit inquiries. If your profile is complex, Torro’s funding specialists may help identify the most realistic program.

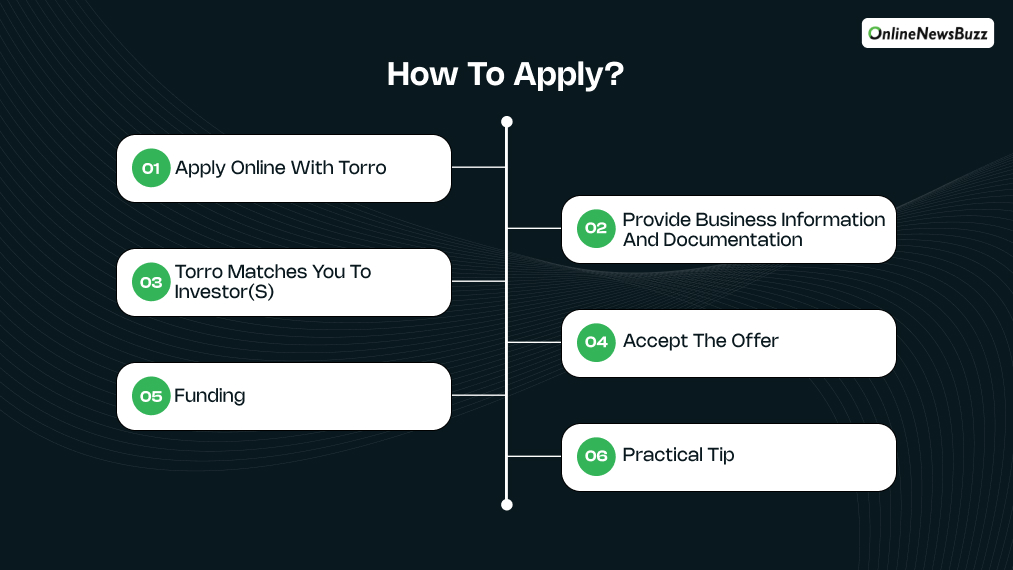

How to Apply?

The application process is straightforward and digital:

- Apply online with Torro by creating an account and describing your funding needs.

- Provide business information and documentation: Revenue details, bank statements, ownership documents, time in business.

- Torro matches you to investor(s) and presents an offer or multiple offers for review. Expect the final terms to appear after underwriting / partner review.

- Accept the offer: Read the APR, fees, repayment schedule, prepayment terms, and requirements for collateral or personal guarantee.

- Funding – money can be deposited as soon as (sometimes the same day) the paperwork and ink are dry.

- Practical tip: Have at least 3 months of bank statements, basic financials, and ID ready to speed the process.

Torro Reviews and Complaint

- Positive reviews: Borrowers tend to rave about Torro for having quick funding, personal attention from funding specialists, and having gotten deals done for startups or borrowers who struggled with banks. Trustpilot and Best Company show large numbers of positive reviews and high average ratings.

- Common complaints: A minority of customers report disputes over fees, unclear expectations before signing, or frustrations when offers change after underwriting.

The BBB shows some complaints and Torro maintains an A+ accreditation in multiple listings, but be aware that – with how most brokerage/syndication models function – the borrower experience depends heavily on the partner investor and the final contract.

What to watch for in reviews? The comments to look out for are regarding effective APR – not nominal, fees including origination, underwriting, servicing, early payoff experience, and whether funding matched the application expectations.

FAQ

Here are a few questions and queries on the topic of torro business funding that others have asked and you might feel helpful at the same time.

1. Is Torro the lender or a broker?

Torro acts mainly as marketplace/syndicator: it connects applicants with investors and funding partners. In other words, Torro facilitates the deals, but partner entities may be the ultimate source of funds. Read your contract to see who holds the loan.

2. How much can I borrow through Torro?

Typical ranges given are $5,000 up to $725,000, with some product limits and program caps. Startup tracks, for example, may have lower maximums. Check product caps when applying.

3. What APRs should I expect?

A Finder reports APRs up to 36%; actual APR depends on product type, state regulations, creditworthiness, and investor partner. Some MCA or short-term products will show higher effective costs than a quoted APR because of factor rates and fee structures.

4. Does Torro fund startups or businesses with bad credit?

Yes, Torro advertises startup funding and flexible credit acceptance. Finder notes applicants with credit scores as low as ~400 may be considered for some programs. That said, lower credit or no revenue may lead to smaller amounts or higher cost offers.

5. Are there hidden fees?

Torro does try to make the fees transparent, but reviews often mention how surprise costs arise when the offers actually come in from investor partners.

Always request a full written breakdown of origination fees, underwriting fees, and servicing before accepting an offer. Confidence is critical in virtually every endeavour.

Who should use Torro?

Use Torro if:

- You must have quick access to capital – in days, not weeks or months.

- You are a startup or have low credit, and traditional lenders won’t consider you.

- You value a hands-on specialist to help match to a solution.

Be cautious if:

- You need transparent, low-cost long-term financing — banks/ SBA may be cheaper.

- You are price sensitive and don’t want variability in fees or APRs — insist on full cost disclosure before signing.