Creating a financial model is crucial for understanding the economics and planning the growth of a SaaS business. A model forecasts revenue, costs, cash flow, and other key financial metrics to guide smart decisions.

In this article, we’ll walk through the key components of building a thorough SaaS financial model. We’ll also explore strategies for making models more dynamic planning tools. Let’s get started.

Overview Of Modeling Goals

A SaaS financial model templates serves several essential purposes:

- Project growth – How will revenue, customers and costs evolve over time? When is profitability reached?

- Assess metrics – How do unit metrics like customer lifetime value (LTV), churn, etc. impact the business?

- Test scenarios – How do changes in assumptions like pricing or customer acquisition costs affect finances?

- Guide funding – What investment is required to fuel growth goals? How does dilution from funding affect equity?

- Attract investors – Models demonstrate planning rigor and the viability of your SaaS business.

Thorough modeling provides the visibility needed to control your startup’s financial destiny.

Key Sections Of A Saas Model

While customized to each business, SaaS models typically contain linked sections. Firstly, there are the Key Metrics. The base unit assumptions, such as average deal size, churn rate, gross margin %, etc., drive the whole model.

Following the first model, there is the revenue build. The question that arises here is how monthly recurring revenue grows over time based on sales projections and retention rates.

Moreover, you must consider operating costs, including fixed and variable expenses like hosting, payroll, marketing, R&D, etc.

After that, you have the drivers. It’s a summary of high-level model drivers and calculated metrics like CAC and LTV. Again, the Income Statement is one point that must be discussed. It denotes a Multi-year projection of revenue, costs, EBITDA, net profit, and other elements.

Lastly, there are some other elements that form the key to the SAAS Section, including the Cash Flow Statement and balance funding and valuation. Hence, thoroughly modeling each area provides a complete view of the startup’s financial trajectory.

Best Practices For Credible Models

Follow these standards to ensure your model is investment-grade:

Document Assumptions

Detail every assumption behind projections in a dedicated section. Now, explain how figures were estimated.

Hyperlink To Sources

Hyperlink key data points to source documents or calculations. This facilitates checking.

Include Charts

Charts allow quick trend visualization for key metrics and growth curves.

Build Scenarios

Create alternate version models to test different assumptions. Ultimately, this reveals scenario impacts.

Add Validation Checks

Formulas that check totals match projections or align calculations. However, this helps spot errors.

Automate Projections

Build projected figures using formulas based on assumptions and drivers versus manual inputs.

Following best practices makes your model robust, transparent and investment-ready.

Modeling Recurring Revenue

Since revenue primarily comes from ongoing monthly subscriptions, accurately modeling recurring revenue growth is critical for SaaS companies.

Key elements include:

- New MRR – New monthly recurring revenue added each month through sales. This starts small and then scales rapidly as marketing and sales mature.

- Churn Rate – Percent of existing MRR lost each month due to cancellations. Keeping churn low through retention efforts is imperative.

- Net MRR Increase – How much net MRR is added each month after factoring in churn? This paces total MRR growth.

- ACV and Subscriber Inputs – Model ACV (average contract value) and new, lost, and total subscribers based on sales and churn assumptions.

- Total MRR – Sums beginning MRR, new MRR, and churn reduction MRR monthly. This becomes total revenue.

Thoroughly model recurring revenue dynamics that drive growth.

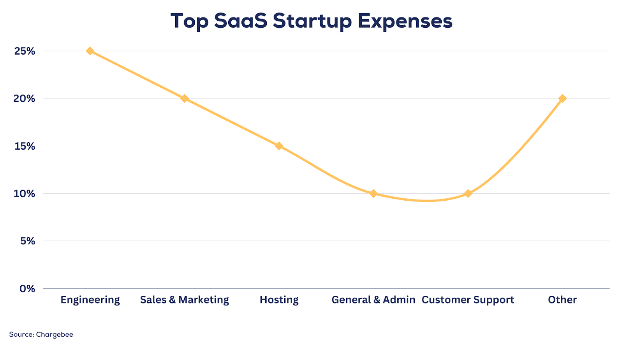

Key SaaS Cost Drivers

Beyond revenue, understanding which costs grow and decline is vital for controlling profitability. Common SaaS cost drivers are:

- Hosting – Variable computing and storage costs. More customers and usage increase these costs.

- Support – Support staff to handle questions and training. Scales by number of customers.

- Sales & Marketing – Salesforce payroll and advertising are big upfront costs that pay off in revenue later.

- Product & Engineering – Vital talent for developing features, but too many engineers bloat costs.

- Marginal Costs – The cost for providing the service to one additional customer. Keeping this cost low through automation maximizes unit profitability.

- General & Administrative – Legal, finance, HR. Model headcount and fixed costs cautiously.

Rightsize expenses as the business expands by understanding cost drivers.

Integrating Key SaaS Metrics

Unit metrics fundamentally shape a SaaS model by driving recurring revenue and cost amounts. Key metrics include:

- Lifetime Value per Customer – Average revenue per customer over their full lifecycle minus gross margin %

- Customer Acquisition Cost – Cost of sales and marketing efforts per new customer

- Churn Rate – Percent of customers canceling monthly

- Gross Margin – Revenue remaining after subtracting costs of providing service

- Burn Rate – The average monthly cash spend

Derive other vital rates like payback periods using ratios between metrics. Integrate metrics tightly with projected growth and expenses.

Building Model Flexibility

Hard-coded projections make models rigid. Introduce flexibility by:

Driver-Based Formulas

Build projections using formulas tied to assumption variables. Changing assumptions instantly updates forecasts.

Scenario Modeling

Create multiple interchangeable models with different assumptions to assess various scenarios.

Sensitivity Analysis

See the revenue and cost impact of adjusting one variable at a time using a sensitivity table. Helps identify the riskiest assumptions.

Variable Timeframes

Allow dynamic date inputs for time horizons rather than fixed years. Enables extending projections further as business matures.

Regularly test different scenarios and assumptions to make models more nimble strategic tools. The future is uncertain – ensure your model can flex as needed.

Forecasting Costs Over Time

Model cost growth by assessing how expenses scale over time as customers and revenue expand.

Fixed Costs

Expenses like rent, leadership salaries, and software licenses. Moreover, these remain constant as revenue rises.

Semi-Variable Costs

Costs that increase gradually with revenue like cust. Success and admin roles once exceeding certain thresholds.

Variable Costs

Directly grow in proportion to revenue or customers like hosting fees, sales commissions, and support staff. The model increases based on projections.

Step Function Costs

Costs increase in large chunks with major team or office expansions as milestones hit.

Blending cost types for each expense provides realistic scaling projections and avoids drastic forecast revisions.

Building Cap Tables To Track Equity

A capitalization table (or cap table) is crucial for tracking equity ownership through funding rounds. Essential cap table components are:

- Founder and investor shares, percentages and values

- Share prices for each funding round

- Employee stock option plans

- Equity dilution from new shares issued in funding rounds

Cap tables help founders understand the impact on their ownership as investment is raised. Keep this equity snapshot updated with every funding event or stock issuance.

Assessing Startup Health

Models allow analyzing overall startup health by calculating:

- Cash Burn Rate – The average net cash spent per month. Needs to slow down over time.

- Runway – Months until projected cash balance can sustain operations given burn rate. Must exceed 18 months.

- Profitability – When monthly net income reaches breakeven. This is a key viability milestone.

- Valuation – What the company could be worth based on revenue multiples or discounted cash flow methods. Valuation should increase over funding rounds.

Monitoring these measures spots weaknesses requiring corrective action early.

Presenting, Updating, And Avoiding Financial Modeling Pitfalls

When presenting your startup to potential investors, it’s crucial to have a strong financial model. However, consider emailing the model to investors before your formal pitch to make the most of these presentations. During your meeting, walk them through the model, explain key assumptions and calculations, and demonstrate how changes impact your business. Be transparent about uncertainties and welcome investor feedback.

As your startup evolves, your financial models must evolve with it.

Moreover, they should align with real operational and financial performance. Regularly update your models by undergoing continuous Financial Modeling Education which can help you compare projections to actual results and refine assumptions. It can also help you add new cost categories as they arise and extend future projections when your business matures. By keeping your models in sync with reality, they become valuable tools for financial planning.

To avoid common modeling mistakes, start your financial planning early, document your assumptions, keep models flexible, and focus on core business drivers. Test riskier assumptions and ensure your models adapt to changing circumstances. This proactive approach will strengthen your models, guiding your startup’s growth and decision-making effectively.

Key Takeaways

- SaaS startup models project key financial statements and metrics to guide growth.

- Key model components include revenue, costs, KPIs, cash flow, funding, and valuation views.

- Build flexibility through driver formulas, scenarios, sensitivity analysis, and variable timeframes.

- Adapt models by integrating real data, extending projections, and updating assumptions.

Robust models provide clarity on the economics and viability of a SaaS venture – critical for impressing investors and controlling your startup’s trajectory.

FAQs

What are the most important things to model for SaaS startups?

First, focus on thoroughly modeling recurring revenue, unit economics like CAC and LTV, capitalization tables, cash flow, and valuation. These provide the clearest view of growth potential.

What time period should a SaaS model cover?

Build models covering at least 5 years of projections. Moreover, extends further as business matures. Short-term models lack helpful long-term visibility.

How detailed should cost assumptions be?

Find the right balance. Also, avoid overly granular projections impossible to predict while still segmenting major cost drivers versus simplified totals.

When should founders create their first model?

Build initial models early, even pre-launch, to test assumptions, explore viability, and guide startup decisions. Thereafter, revisit often as projections meet reality.

Final Thoughts

Financial modeling forms the strategic blueprint guiding SaaS startups to profitability and beyond. However, the accurate financial model provides clarity, accountability, and indispensable visibility for the long-term journey ahead.

Read Also: