Have you seen the gold prices lately? Gold prices have shot up like no other metals in the last decade. Previously, purchasing physical gold was still possible for the middle class, but now that’s no longer an option. I cannot afford to invest in physical gold with such inflated prices.

But what if I tell you there is a way you can benefit from gold’s inflated prices? You can still invest in gold as an asset to get good returns on your investment. No, I am not talking about buying physical gold but gold ETFs. Not sure what I am talking about?

Then, let’s elaborate on what gold ETFs are and why you should invest in them to get good returns in the future.

What Is Gold ETF?

A gold ETF or exchange-traded fund is a type of fund that you can find on the stock exchange for investment. You can invest in gold without purchasing any physical gold through gold ETF. Therefore, you get to invest in the yellow metal without needing to own them physically however much you want or afford.

Additionally, when prices increase on these gold ETFs, you can sell them and get good returns. Furthermore, since each unit of gold ETF represents per gram of gold price of highest purity, you get good returns on selling the ETF.

Additionally, each gold ETF unit tracks the price of physical gold in the market, so you are investing in actual gold.

Often, we don’t have the means and budget to own pure gold in its physical form because of certain limits in purchasing pure gold.

Furthermore, the security of keeping the physical gold stops us from purchasing it in large quantities. Yet we still want to invest in gold to enjoy good returns on its sales in the future.

This is where gold ETFs come in as a passive form of income when you invest in them through exchange. If you want an investment opportunity to increase your passive income, invest in crypto ETFs like Bitcoin ETFs.

History Of Gold ETF

Did you know the first gold ETF was listed in 2003? Gold Bullion Securities was the first gold ETF listed under the Australian Securities Exchange.

Under this gold exchange-traded fund were assets worth 602 million dollars, including physical gold. ETF Securities developed this ETF, and Graham Tuckwell was its major shareholder.

Since then, several gold ETFs have launched on the stock exchange; SPDR Gold Shares ETFs launched on the New York Stock Exchange. This fund crossed one billion in assets within three days of its launch.

Additionally, Vanguard Gold ETF was introduced in 1929 and has grown since then. Therefore, the investment trends are tipping towards more gold exchange-traded funds in recent years. Furthermore, if you are confused about which investment option is better for you among ETF vs Mutual Funds then read this article.

Pros Of Investing In Gold ETF

You might be thinking, why should you invest in gold ETF instead of owning physical gold? In this section, we provide the benefits of investing in gold ETFs.

Hedge Against Inflation

You might be aware that gold prices increase against periods of inflation in the stock exchange. Additionally, gold is an asset you can trust to give you good returns over a long period and not depreciate over time. This makes gold attractive as an investment option.

Furthermore, according to Statista, gold price has reached 2000 dollars USD per ounce as of 2022 and remain high.

Investment Portfolio Diversification

Firstly, if you are someone like me who prefers to keep all their eggs in different baskets, then gold ETFs are a great option for diversifying your portfolio.

When investing your hard-earned money, look for different ways to get good returns on your money. So, invest in various stocks, funds, and bonds to minimize risk and achieve good returns. Therefore, invest in gold ETFs to diversify your investment portfolio.

Additionally, you can invest in other ETFs like Bitcoin ETF, Equity ETF, dividend ETFs, etc. to diversify your investment portfolio.

Security

Secondly, owning physical gold can be a hassle because of the fear of theft if kept at home. Also, if you keep your gold in a bank locker, you must bear annual security charges.

Therefore, security factors play an essential role in owning physical gold, which you can avoid when investing in gold ETFs.

Purity

Thirdly, you will need access to a pure form of gold to purchase it physically. Additionally, purchasing pure gold will cost you a fortune if you get access to it. Furthermore, pure gold in physical form cannot be purchased in small quantities.

However, you get to invest in the pure form of gold through gold ETF, and each unit of the gold ETF represents one gm of the highest purity gold.

Ease Of Trading

Fourthly, selling physical gold and getting the right price whenever you want takes work. Often, gold jewelry makers or sellers try to give you reduced prices for your gold to make more profits for themselves.

However, when you invest in gold ETFs, you can sell them anytime and get the exact market price. Additionally, you can purchase gold exchange-traded funds anytime through the exchange. Furthermore, liquidating gold ETF is easier than liquidating physical gold.

No Loads

Fifth, you don’t need to pay loads when purchasing or selling gold ETFs. So, your investment amount remains secure without any deduction when you purchase or sell your gold exchange-traded fund.

Tax Benefits

Sixth, you get tax benefits on long-term investment in gold ETF, and who doesn’t want tax benefits at present? If you are considering long-term investments for three years, opt for gold exchange-traded funds.

Pledging For Loan Purpose

Lastly, if you require a loan, then you can pledge or keep your gold ETF as collateral to obtain a loan. Since gold is a safe-haven asset, you can depend on financially uncertain times, making it promising collateral when taking out a loan.

Cons Of Investing In Gold ETF

Everything in this world has its limitations, and so do gold ETFs. So, here are some cons of investing in gold ETFs.

Non-Tangible

If you want to own physical gold in physical form, then gold ETF might not be for you. You see, gold exchange-traded funds are non-tangible assets you store online and cannot physically access. So, you cannot wear it and flaunt it.

However, you can sell your gold exchange-traded funds and convert them to cash. Additionally, you can transform your gold ETF into physical gold if you have certain units of gold ETFs that convert into one kilogram of physical gold.

Performance-based Asset

As you know, gold ETF prices are performance-based, which depends on certain factors related to global economic stability. This is because, internationally, gold is considered an asset and used for trading purposes.

Therefore, your fund managers cannot control the price of the gold exchange-traded funds on the stock exchange. So, you should invest a small portion of your overall investment in gold ETF. This will help you minimize risk when uncertain economic conditions or unstable geopolitical situations impact gold prices.

Additionally, you can minimize your risks in investing in gold ETFs and diversify your portfolio.

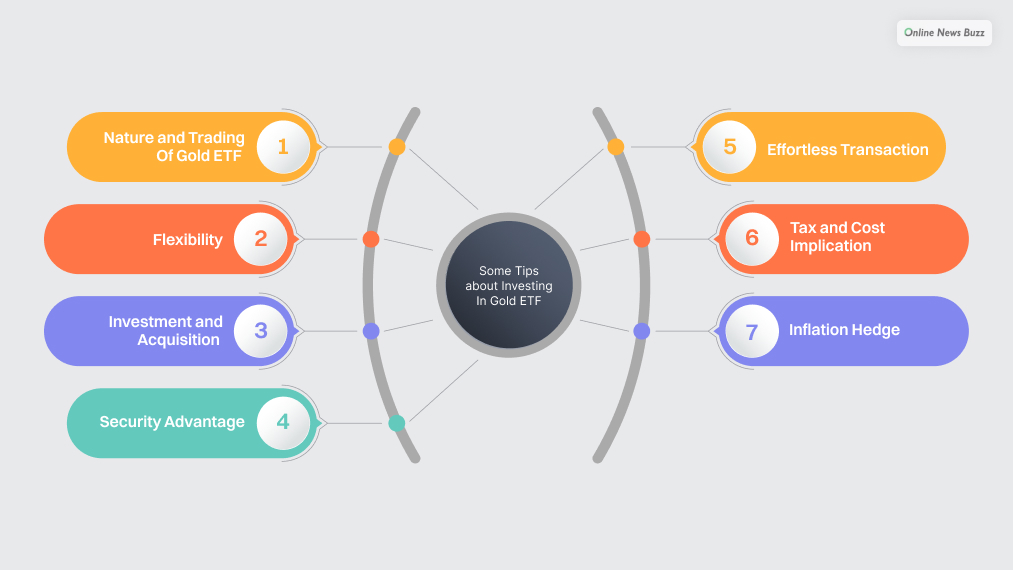

Some Tips about Investing In Gold ETF

If you are new to investing, you should read some investment books and watch investment podcasts to learn about investing. This will help you get a deeper understanding about which investment opportunity is best for you.

If you want to invest in gold ETF here are some more tips.

Nature and Trading Of Gold ETF

Gold ETFs are like open-ended mutual funds you invest in. Just like you invest in regular stocks on the stock exchange, gold ETF investments are done similarly. Your gold ETF per unit represents one gram of 99.5% pure gold you invest in.

Flexibility

You can easily purchase and liquidate your gold ETF into cash or physical gold when demand rises for gold. You have complete flexibility to deal with these types of investments.

Investment and Acquisition

You purchase gold exchange-traded funds through your trading account or Demat account. Purchasing the gold ETF consisting of one-unit accounts for investing in one gram of physical gold under the fund.

Security Advantage

You can forget the hassle of storing physical gold when you invest in gold ETF. Additionally, you do not have to bear the storage cost of your physical gold because your gold ETF stays in your trading account.

Effortless Transaction

When you sell your gold exchange-traded fund, the amount gets deposited into your Demat account. Exchange Trading is much simpler because you can buy and sell any stock or ETF whenever you wish.

Your gold exchange-traded funds mirror physical gold prices in the market, so you get the accurate amount when you sell them.

Tax and Cost Implication

You will get taxed on your gold ETF investment for short and long-term gains. However, you get some tax exemptions for holding gold ETFs for over three years. Additionally, you don’t need to pay exit or entry loads when purchasing these funds.

Inflation Hedge

With inflation in the market every three or more years, gold exchange-traded funds serve as a hedge against market volatility. You get security for your investment when you invest in gold ETF pricing that remains stable during inflation.

Wrapping Up

So, if you want to diversify your portfolio or invest in gold to capitalize on its rising price without owning it physically, you can opt for gold ETF.

Whenever you are investing, try to do your research about different investment options and consult with expert investors. Additionally, you can do your research when investing in any ETFs in the market.

This will help you minimize risks when investing in proper ETFs with higher chances of gains. Furthermore, when you do your research, you start understanding the market much more deeply which helps you grow as an investor.

Read Also: