Business operations and technologies are getting increasingly complicated. Every day businesses are working around thousands of different invoices, payments, and bank transfers. In light of such a situation, it becomes crucial that businesses are able to use the right kind of scanning and printing hardware and software.

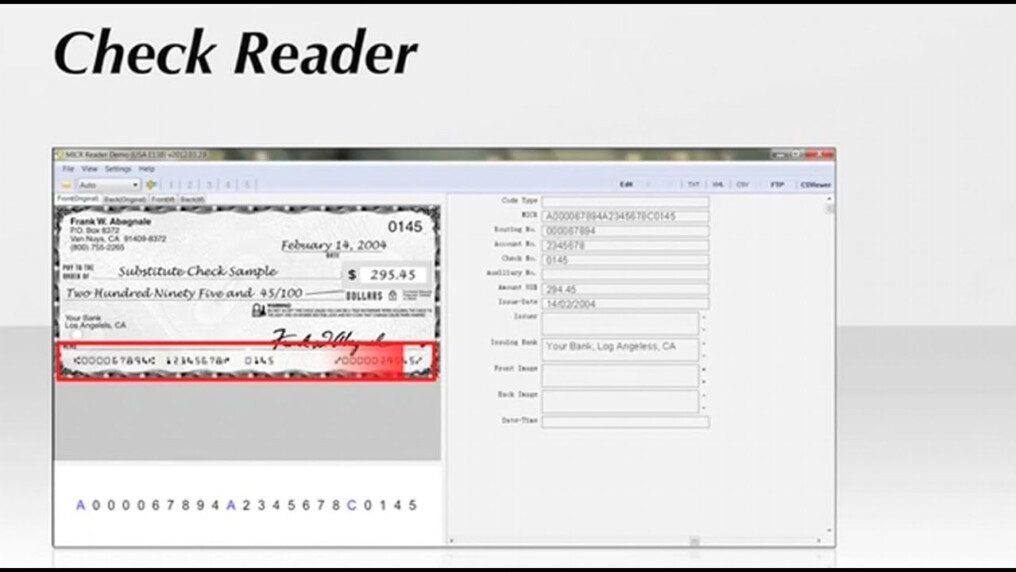

Modern digital scanning technology allows financial and credit institutions to process controls in a very efficient way, accelerating a traditionally labor-intensive process. Check scanners are composed of two fundamental components:

- The hardware that allows obtaining images in very high quality

and

- The software that analyzes these images and can determine the value as well as other important data of the check.

In general, the most challenging part for those who realize check reader software is the handwriting analysis, since this factor can vary a lot from one person to the other. The most innovative check reader software, like the ones of Panini Spa, are able to read the most diverse handwritings. However, if the handwriting is unclear or very bad, the software is “intelligent” enough to prompt an employee in order to type the correct amount reported in the check.

In other words, the software has been created with some preliminary understanding of Machine Learning. This helps the software to predict certain functions and operations.

Moreover, every check has a bank routing number, an account code, and a check number printed at the bottom of it. A check reader software is able to convert these so-called “Magnetic Ink Character Recognition”, or MICR numbers, into the correct bank information. This process is way easier than handwriting recognition since a standardized font is used.

All the information processed through a check reader software is verified and validated in order to ensure the correctness of the whole process and of the transaction. If any information is invalid, automatically the check reader software does not accept the check. It is then the job of an employer to analyze the check again and determine if it was just a misunderstanding with the software or a check which is really not valid.

Even if nowadays fewer and fewer checks are used, having a check reader machine and software is always useful in the case of financial and credit institutions, as well as in post offices. A check reader software, together with an automated signature verification system, helps financial and credit institutions lower the risk of fraud when dealing with checks, especially when it comes to a big amount of money.

All of this has three positive effects:

- Reduced financial loss for the credit or financial institution.

- Increased staff productivity, since it has not to manually process every single check, but it is called into action only in case of doubt.

- Increased customer loyalty, since frauds do not take place.

Therefore, there are enough reasons for choosing and buying a good and trustworthy check reader software. Panini Spa offers different products with different features, just contact its staff that will answer any question.

Conclusion:

In view of the complications at modern business houses, getting the right scanning software and hardware can make all the difference to your business. By having the right equipment in the office, you can increase the productivity of your employees. A brand can help grow its organization in a structured and systematic manner by taking help from technology.

If you wish to add more to the article, hit us up in the comments section below.

Read Also: