It is never easy for traders to invest in a strained financial market with so many online trading platforms to choose from. Moreover, it is also overwhelming and time-consuming, with so many options available to find the right one that suits your particular needs.

So, how do you invest online? Here, we are going to go over the basics of how to invest online and speed up the learning curve. Let’s check out the basics of online investing and see some of the interesting factors that traders should think about before making their first trade. Let’s make investing for beginners easy.

Select an online broker, to begin with

Thinking about how to invest in the stock market? Well, start from the very beginning. The process of “how to invest online,” begins with choosing an online broker. However, you have to consider a few things before investing online.

Regulation

Make sure the broker you are choosing is registered to sell securities. Any investor can do this easily by checking the BrokerCheck by the Financial Industry Regulatory Authority. All you have to do is enter the broker’s name in the search function.

Platform security

To protect your identity and funds, choose an online broker with enhanced security features. For instance, email or SMS login security notification alerts and two-factor authentication. Moreover, they have to agree not to sell any kind of personal information to a third party.

Fees/Commission

If you have plans to actively trade, then you should consider choosing a broker with competitive trading commissions. This will help in adding up fast. Even though different brokers offer zero commission, be cautious as they might make money with a huge spread between the bid price and the asking price.

Moreover, determine whether the broker charges any minimum deposit fees, monthly or annual maintenance fees for the account, activity fees, and data fees. Some brokers charge a certain amount for not trading with a quarter.

Product offerings

Ensure the platform you choose offers all the products you wish to trade. For example, if you are thinking of reading complex strategies utilizing investment instruments, make sure the platform allows stocks, options, exchange-traded funds(ETFs), and feature trading.

Various popular online trading apps like Webull and Robinhood have started offering and lending cryptocurrencies on the trading platform and drawing a crypto wallet. New traders looking for how to trade online should choose an online broker offering stock simulation accounts or paper trading to develop their skills before they risk some real money.

Online reviews

Before you start online stock trading, look for what others are saying about the broker you have chosen. Look deeply into the reviews about their customer service, account fees, and platform usability.

To have an accurate reflection, make sure the broker has a lot of reviews. Check whether there is a pattern among the reviews that the customers are leaving.

For instance, if a few reviews complain about their customer service and response time, then there is a chance that they need to improve their services in those areas.

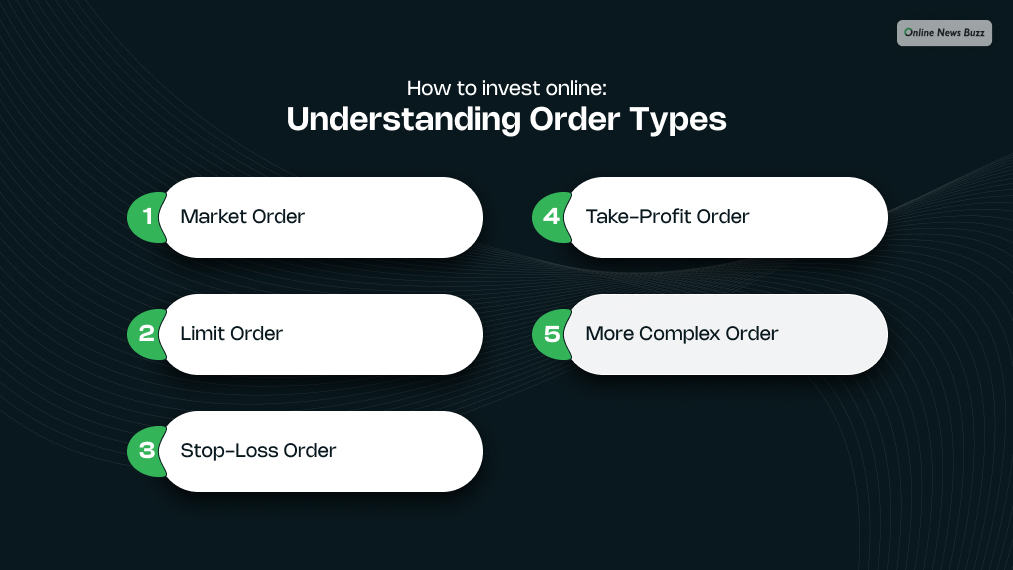

How to invest online: Understanding order types

With learning how to invest online, there are also the basic order types that all investors should get accustomed to, as these are the same for all trading platforms. Knowing how this works and when to use them helps a lot while executing a trade and managing risk.

Market order

A market order is the order to sell or buy any security at the best possible price. For instance, if the ask/bid spread in Apple Inc. was $180.00-$180.10, and a trader wanted to buy a stock at the market.

They will get filled at $180.00 immediately, which is the best ask price. Traders use market orders when they need to execute something immediately.

Limit order

A limit order is a maximum piece that any trader is willing to pay for security in terms of the buy limit order or the minimum they will accept in terms of the sell limit order. Let’s take the example we used before, where the ask/bid spread in Apple Inc. was $180.00-$180.10.

However, the trader believes they can sell it at a much higher rate. That is when they can set the limit order at $200, meaning they will not sell their stock unless it reaches $200. Limit order matters more for those traders who focus on the price and not on immediate execution.

Stop-loss order

This helps in controlling the risk of a trader by selling or buying at the market price when the security has already traded at a specific price. Meaning, that if the security has already reached the stop price by the trader, the order then becomes a market order and gets executed at the next best price.

For instance, when a trader purchases Apple stock at the cost of $200 but wishes to get out if the price gets under $150. That is when they place a stop-loss order at $150. If, by any chance, the stock goes below $150, then the stop order automatically becomes a market order. And the trade is filled at the best possible bid price.

Take-profit order

As the name goes, this type of order is set at a specific price to close one of the open positions to make a profit. If the security price reaches the limit, the sale will be triggered automatically.

More complex order

Besides the basic orders, numerous online trading platforms offer complex order types like OCO or one-cancels-the-order, AON or all or none, and FOK or fill or kill.

Best Ways to Invest Money in 2024

Here are the five best ways to invest your money right now. It is ordered from the lowest risk to the highest ones. However, with the low-risk options, the chance of getting better returns also reduces. The options with higher risk come with a chance for better returns.

- High-yield savings account – These are best if you are planning to save for a short time or if you want to access the money occasionally. Certain banks limit the savings account transactions to six every month. Cash management accounts provide flexibility with similar interest rates.

- Certificates of deposit – You can invest in a CD, if you know you will not need the money suddenly. If you are saving the money for some particular date and event, then this might be a good option for you.

Common term lengths are from one to five years, so if you want to grow the amount for a particular purpose then this is a good option for you.

- Bonds – This is a relatively save kind of fixed income. However, lower-risk bonds are likely to pay low-interest rate as compared to high-risk bonds.

- Funds – Money market funds are investment products. However, people often confuse it with money market accounts, which are bank deposit accounts, very similar to savings account. When you invest in this kind of fund, you buy a collection of high-quality, short-term corporate, bank and government debt.

- Stocks – A stock shows the ownership share you have in the company. Stocks have a larger potential of returns on the investment than any of those lower-risk investments, like government bonds, but there is also a higher risk with this kind of investment.

What is the Best Stock Investment in 2024

Individual stocks are the best ones for investing in right now. They have a larger potential return on the investment than any other low-risk investment, like government bonds. These can also expose your money to high volatility.

Investors who have a well-diversified portfolio and are willing to take on some risk can invest in these stocks. Because of the volatility of the individual stocks, a good thumb rule for investors is to limit the individual stock holdings to less than 10% of the overall portfolio.

Do your research well

There are numerous free resources online to help you with your online investment. Some sites provide online data on price-to-earning or P/E ratios, company financials, and market capitalization.

If you like charting, then there are web-based charting sites that give traders a detailed technical analysis, discuss market trends, and share ideas with them. There are also platforms for running scans depending on fundamental or technical metrics.

Also, when screening for stocks, investors can check what stocks and what sectors are moving with the help of a heatmap. This research tool has both premium and free service, which also applies to ETF markets. Moreover, you get to filter by time frame, making it simple for both online day traders and buy-and-hold investors.

Even when you know how to invest online, plan, and execute the trades, you still might need help from a registered investment advisor. They can help you navigate the volatile financial market and access exclusive broker research.

Read More…