Company setups can differ significantly.

However, two of the most famous business structures are the sole trader and the limited company.

Below, we’ll look into some of their differences

What is a Sole Trader?

A sole trader is a person who owns and controls a company they set up. Also known as a sole proprietorship or one-person business, a sole-trader corporation has financing from a singular source. You can set the company up however you like and hire as many people as you will need.

However, you control everything that has to do with the business and take all major decisions.

When you run as a sole trader, you are personally responsible for the business. The law also sees you and your business as the same entity, so you are personally liable for business losses or debts that the company incurs. On the flip side, this also means that you will keep all profits after expenses have been considered.

Most sole-trader businesses are specialist services like plumbers, hairdressers, electricians, and more. These companies are relatively less expensive to start, and their operating structures aren’t so complicated. So, it is easy for one man or woman to set the company up and operate it.

What is a Limited Company?

If you decide to run your business as a limited company, you will essentially be setting up a private organization that runs its activities. A limited company is a legal entity before the law, and unlike a sole trader, it has its legal identity that is separate from that of its owners.

By maintaining its separate legal identity, your limited company will also need to have its finances different from those of its shareholders and managers. You will want to hire limited company accounting services to handle the books to ensure that everything is functioning as it should. As a director or a shareholder, you have limited liability for the company’s losses and debts.

Essentially, your exposure to the company is limited to your stake in it.

You should note that there is no maximum number of shareholders that a limited company can have. The minimum is one, and you can bring in as many people as you need to invest in the company and provide financial capital for running its operations. Whether one person or several people operate the company, a limited company’s rules remain the same.

Understanding the Differences Between the Two:

The primary difference between a sole trader and a limited company boils down to their definitions. A sole trader business is owned and controlled by a person with unlimited business liability, while a group of people owns a limited company.

A limited company’s shareholders have limited liability for the business as well, so setting up a limited company offers less personal monetary risk for each shareholder.

Beyond that, we can point out several other inherent differences. Let’s look into the benefits and drawbacks of each.

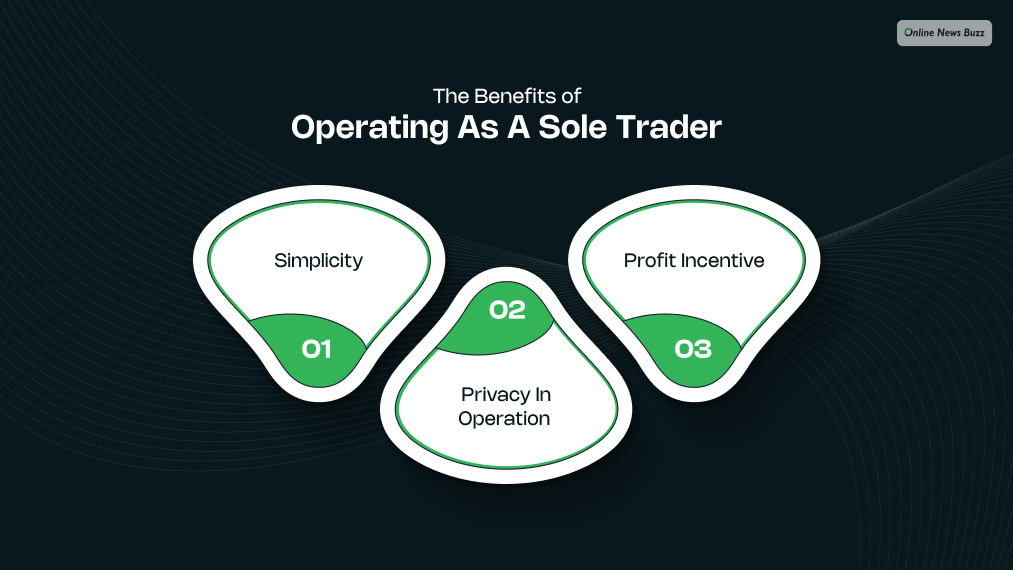

The Benefits of Operating as a Sole Trader-

Simplicity:

Running as a sole trader is easy. You can quickly set your company, and you don’t need so much paperwork. Note that you will need to complete a self-assessed tax return annually when you set up. Other than that, there are few requirements that you’re obligated to meet.

Privacy in operation:

Most sole-trader businesses don’t need to register with any regulators. So, you don’t have to share any company information with anyone.

Profit incentive:

As a sole trader, you get to keep all company profits in a good year. You will most likely need to offset costs like salaries and other expenses from revenues, but the profits at the end of the day are yours.

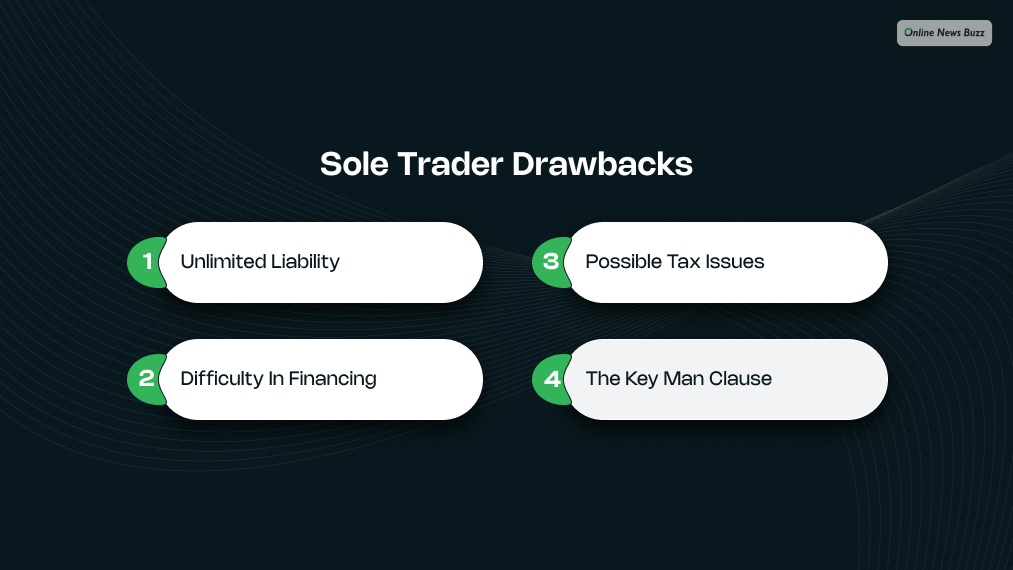

Sole Trader Drawbacks-

Unlimited liability:

The primary drawback of a sole-trader company is that you have unlimited liability. As a sole trader, the law doesn’t see you as having a separate identity from your business. So, if the company goes into debt, you are liable and could lose personal assets as you try to offset the financial obligations.

Difficulty in financing:

Another challenge with running as a sole trader is that you might not find it easy to raise funds. Most investors and banks would prefer to invest in companies where they can get ownership stakes, and since that isn’t your case, you’re on your own. Over time, you might find that these challenges could hamper your company’s growth potential.

Possible tax issues:

In some countries, business and personal income and expenditures are treated as one. This means that you might have to pay even higher taxes as a sole trader once your business grows to a certain level.

The key man clause:

Many sole traders have the key man clause – essentially, if something were to happen to the company owner, the company might cease to exist. So, if the sole trader dies or cannot perform their duties, employees could suddenly be laid off or unable to access their salaries.

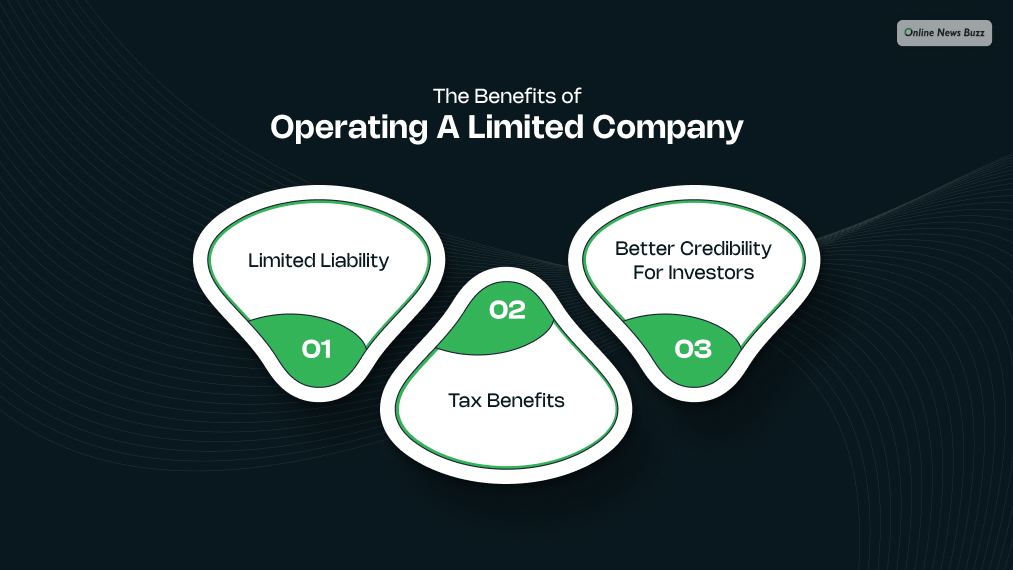

The Benefits of Operating a Limited Company-

Limited liability:

Since your company is legally different from its managers and shareholders, your personal assets are safe if the firm runs into financial problems.

Tax benefits:

When the organization grows to a certain level, being a limited company could be more tax-efficient. As a company director, you can pay yourself in dividends and avoid high-income tax payments. You could also claim several other allowances as a limited company to reduce your tax obligations.

Better credibility for investors:

There is a level of prestige that comes with being a registered limited company. You have more credibility in the market, and it is easier for you to raise funds.

Limited Company Drawbacks-

The company’s drawbacks, although limited, are still present!

Greater Administrative Responsibilities

One of the biggest challenges of running a limited company is that it comes with more administration.

You will need to complete an annual return and file annual accounts and possibly VAT returns (if your business is VAT-registered). Plus, you will also have to make sure you keep up to date with Corporation Tax and payroll taxes with limited company accountant.

As a company director, you are also a person of trust. In addition to the legal responsibilities, there is another level of responsibility – ‘fiduciary responsibilities.’ That is, also thinking about the beneficiaries.

You have to act in the best interests of the company and its shareholders and make decisions that will benefit them in the long run.

Not doing so can get you into legal trouble as well. Hence, it is important to be aware of these.

Now, that is quite some stress!

There is Help Available!

If you feel this is too much for you at this stage, worry not. There are many who would be willing to help you.

I am talking about accountants or financial advisers, but obviously at an additional cost.

While your business might not generate enough cash in its earlier phase to justify getting such advisors on board, we suggest you reach out if it starts doing so to avoid potential pitfalls.

Less Privacy is Inevitable

But running a limited company means that you’ll have less privacy in your business affairs. Limited companies must disclose certain financial and operational information to government regulatory bodies.

Such as Companies House (in the UK) or the SEC (in the US). So, your company’s financial statements, details of directors, and even information about shareholders could become public knowledge.

For most business owners, though, this lack of privacy isn’t an issue. Particularly if you don’t mind your financial information being sent out for public scrutiny. While such a requirement can be scary to some entrepreneurs, it has its benefits.

After all, the more transparent you are, the easier it is for anyone who is considering investing in or partnering with your company.

The plus side?

Certain investors and customers will find that level of transparency appealing.