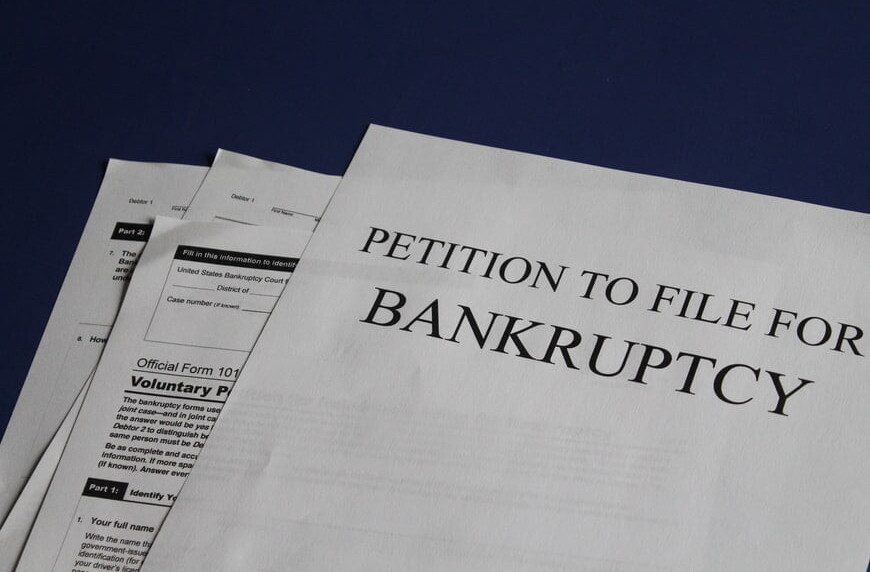

Are you thinking of filing a bankruptcy? Are you hesitating whether it will be the proper solution or not? Are you looking for the advantages and the disadvantages of bankruptcy? Here, in this article, we will guide you with all the necessary details.

What Is Bankruptcy?

When people and businesses are in such a financial crisis that they can not even repay their debts as agreed, they file bankruptcy. During this time by filing a bankruptcy they can get a fresh financial start. This legal process of getting a new financial start is called bankruptcy.

Under the supervision and protection of the court, a fresh financial start is obtained by stretching the monthly payments or by eliminating all or a particular portion of existing debt. This process is designed for protecting the creditors as well.

Advantages Of Filing For Bankruptcy

Now, as you get the basic knowledge of bankruptcy, here are some advantages of filing bankruptcy in the United States Of America.

1. An Automatic Stay Against Creditors

As soon as you file bankruptcy, the court will automatically issue a stay against all debt collecting activities. It will not cancel your debt at all, but it will suspend any type of debt collection procedure till your case is complete.

2. Credit Score

In filing for bankruptcy, although troubles of a completely failed credit ranking delay many. Apart from that, filing for bankruptcy reflects on your record for almost 7 to 10 years. As a result, many debtors start improving their credit scores after they file bankruptcy.

3. Dischargeable Debts

Here, you might be capable of canceling or discharging your responsibility to repay your debts. A discharged debt is one of those, which can be removed by bankruptcy. All these debts involve medical and utility bills, credit card debt, and personal loans.

4. May Get To Maintain Ownership Of Your Property

In case you become able to “exempt” an asset, it means you must not worry about your property being seized by bankruptcy. Some exceptions also can protect up to a specific dollar amount of an asset. Sometimes, it covers the entire value of an asset.

Disadvantages Of Filing For Bankruptcy

So, you get an idea about the advantages you will get when you are filing for bankruptcy. It is time to have a look at the disadvantages, which will come along with it.

1. Loss Of Credit card

When you file for bankruptcy, a number of credit card companies cancel any card automatically, which you hold. After filing, you might get a number of offers for applying for “unsecured” credit cards. This will assist you in rebuilding your credit score.

2. Loss Of Property And Real Estate

Often, all real estate and personal property do not fit under the exemption. It means bankruptcy court will have the authority to seize a part of your property and also can sell it to pay your creditors.

3. Denial Of Tax Refund

As a result of bankruptcy, federal, local, and state tax refunds can be denied. It can be really challenging during a difficult time like this. Consulting with a Bankruptcy Attorney Marietta GA will get the answers to these types of tax-related queries.

4. Difficulty Obtaining A Mortgage Or Loan

Filing bankruptcy could make it really challenging to get another mortgage or loan for several years. In order to get a more detailed idea and understanding visit website.

5. Non-dischargeable Debts

There are some specific types of debts, which can not be discharged by bankruptcy. These kinds of debts usually involve student loans, child support, criminal fines, and restitution, any other debts acquired through fraud.

6. Housing And Job Stigma

Some landlords and also potential employers often ask about any recently filed bankruptcies. So, it can impact your chances for both in a negative manner. A Bankruptcy Attorney Marietta GA will be able to explain all the complexities in a simpler way.

Final Thought

When you are planning to file for bankruptcy, it is mandatory to consider all these advantages and obviously the disadvantages as well. This is why consulting with a Bankruptcy Attorney Marietta GA, is crucial prior to making any firm decision.

Read Also: