Few of us can make a major purchase, such as buying a house or a car, without a little help. Typically, that help comes in the form of a loan. And no lender worth its salt will give you one unless you have a solid credit history.

To borrow money for major purchases, you have to borrow money for smaller things first. That’s how you build a credit history. The better the history, the easier it is to obtain more credit on better terms.

One of the best and fastest ways you can improve your credit and credit score is by using a credit card. While that may sound antithetical to paving the way toward a major loan, it’s not. That is, it’s not if you use the card wisely.

If you need to establish a credit history or you need to raise a less-than-stellar credit score, consider using a credit card.

Facing Your Fear of Credit Cards

In the past, Millennials famously earned the reputation of eschewing credit cards. However, more and more of them are now using those cards. Because of that fact, Millennials are raising their credit scores at a faster rate than any other generation.

Perhaps they figured out that credit cards are a “necessary evil” for building credit. Without credit, they can’t buy a house or a car. Contrary to popular belief, Millennials really don’t want to live with their parents forever.

There are options available for those who are afraid of credit cards. A credit builder card is a secured account that keeps you from overspending while bolstering your credit score. Many secured cards require a minimum security deposit, which becomes the user’s credit limit. Others simply allow the user to transfer funds from a checking account to the card, which they can then use to make purchases.

In fact, some secured card issuers don’t charge interest or fees because you’re not actually borrowing any money. What’s important is that providers of secured credit cards report your payment history to credit bureaus. So even though you’re spending your own money, you should still strive to keep your utilization rate low.

The Meaning of Your Utilization Rate

The credit card utilization rate is the percentage you use each month of all your available credit. Let’s say you have a credit card with a $10,000 limit, and the unpaid balance is $2,000. That means your utilization rate is 20%, which is well below the recommended maximum of 30%.

The lower the utilization rate, the higher the credit score. That’s why having an ample amount of credit available to you is important. And why not using much of it at any one time is better?

A good credit card utilization rate is the result of using your credit card wisely. Doing so will help you qualify for better cards. The higher your credit score, the lower your interest rates and the greater your card rewards.

Ways to Hit the Credit Card Utilization Sweet Spot

Credit card utilization is key to building credit and improving credit scores. That’s why you’ll want to keep that number low. Here are five smart ways to achieve a good utilization rate:

- Keep your credit card balances low or, better yet, pay them off entirely. As noted, to maintain a good credit score, your utilization rate should be less than 30%. Ideally, don’t put more on the card than you can pay off every month.

- Make timely payments. If you don’t make a payment by the due date, your credit score will take a hit. Download a calendar app to help remind you of these dates.

- Better still, make payments early. Paying down the card balance prior to the due date means lowering your balance before interest is added. Lowering the balance early will also reduce the utilization rate.

- Pay off unmanageable credit card debt with a personal loan. A loan likely will have a lower interest rate than your credit card. And because a loan isn’t revolving credit, it’s not part of your utilization rate.

- Increase your credit limits. If you do the math, you’ll see how more credit will reduce your utilization rate. But remember that requesting a credit limit increase usually prompts a hard inquiry into your credit history, which will lower your credit score.

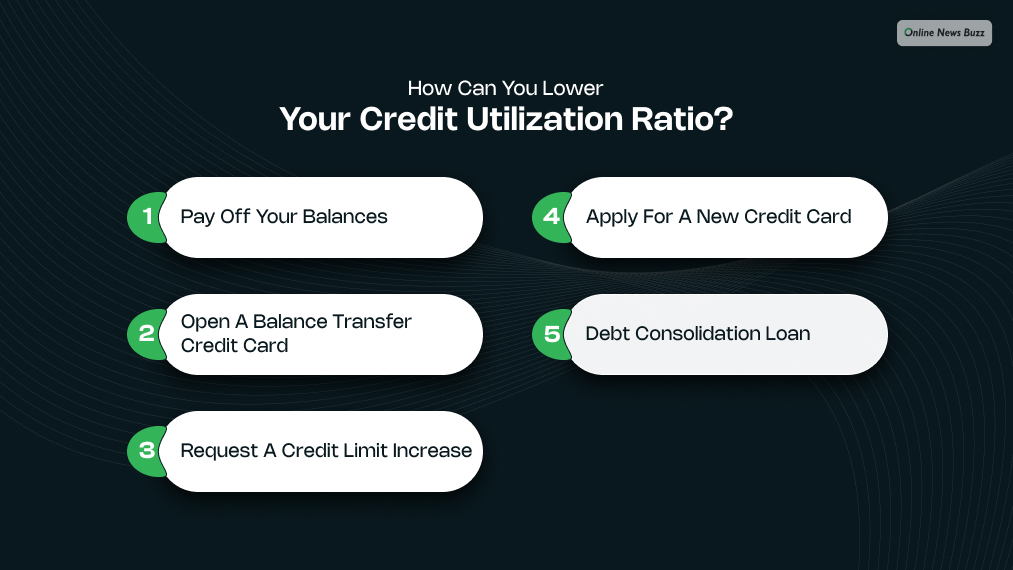

How can you lower your credit utilization ratio?

Lowering your credit utilization ratio is relatively easy — and it’s one of the quickest ways to boost your credit score. Here are four ways for you to reduce your debt, increase your available credit and reap the benefits of a lower credit utilization ratio:

Pay off your balances

The best way to lower your credit utilization ratio is to pay off your credit card balances. That’s easier said than done in some cases, but every dollar you pay off reduces your credit utilization ratio and your total debt, which makes it a win-win scenario.

Plus, paying off your balances means no longer having to pay interest on those balances. So, calculate how much debt you can pay off in the next few months, and see how it affects your credit utilization and credit score.

Open a balance transfer credit card

If monthly interest charges are making it difficult to put a dent in your debt, you might want to consider a balance transfer credit card. These cards let you transfer and consolidate your outstanding balances onto a single credit card, which often makes it easier to pay down your debt. The best balance transfer credit cards offer an introductory 0 percent APR period of 12 to 21 months to help you pay off your balances interest-free.

There’s one more benefit to opening a balance transfer credit card: When you take out a new line of credit, you increase the amount of credit under your name. This can help you lower your credit utilization ratio, provided you don’t make additional purchases that take up a significant percentage of your total credit.

Request a credit limit increase

Another good way to lower your credit utilization ratio is to request a credit limit increase from your credit card issuer. By increasing your credit limit, you’ll have more available credit on your account, which will automatically lower your credit utilization ratio. Just be careful that you don’t turn your new credit into new debt!

Apply for a new credit card

Getting a new credit card is also a good way to lower your credit utilization ratio. Having multiple credit cards associated with your account increases the amount of credit available to you, and if you don’t increase your overall spending, your credit utilization ratio should go down. Plus, applying for a new card gives you the opportunity to take advantage of credit card rewards, sign-up bonuses, and other perks you didn’t have before.

Debt consolidation loan

If you have more than one credit card with a high balance, it can be challenging to make significant progress on lowering your utilization (and your debt) using the previous methods. Instead of a balance transfer card or requesting a limit increase, you might consider a debt consolidation loan instead.

Don’t Get Rid of Your Paid-Off Credit Cards

You’ve finally paid off that high-interest credit card. Congratulations! Now you should close the account, right? Wrong.

Keeping credit card accounts open means you still have that credit available to you. Since you’ve paid it off and aren’t using it, your utilization rate drops. Remember, a lower utilization rate means a higher credit score.

The only risk to leaving accounts open is that they’ll be left open to the potential for fraudulent use. Since you are no longer using that card, it’s out of sight and out of mind.

To mitigate this risk, monitor your credit card routinely. Your inbox or card app should remain silent. If something pops up, notify the card company immediately.

Furthermore, periodically request a copy of your own credit report. All three major reporting companies are required to provide one free every 12 months upon request. Requesting your own report is not a hard inquiry that could lower your credit score. Those are generated when someone is checking your history in advance of giving you more credit.

Handle Your Credit With Care

Credit is a privilege. A good credit report is a responsibility. Responsible credit card utilization is a way to reach your financial goals.

If you’re concerned about your ability to handle credit responsibly, you have options. Secured credit cards give you the credit bureau reporting you need while preventing you from spending over your limit.

Unsecured credit cards allow you to spend more than you have in the bank. You may have occasions where you need (or want) to live a bit beyond your means. Just be sure you don’t wade in so deep that you can’t get back out.

Good credit isn’t just about buying a home or a car. It’s also often necessary for less expensive necessities. For example, you may need decent credit to connect utilities, purchase a cell phone and data plan, or buy insurance.

To be worthy of credit, you need to be creditworthy. So use your credit card to prove your worth and reliability. It’s arguably the best tool in the financial toolbox to achieve that goal.

Read Also: